Blog

Switching mortgage lenders for a lower rate

Posted by Brad Speniel | May 22, 2015 at 1:27 pm

ESTIMATED READING TIME: 2 minutes

With today’s historically low rates, many Canadian homeowners are looking for advice as to whether they should move their mortgage for a better rate. You can switch to another lender at any time, although the renewal date is often when homeowners decide to transfer their mortgage. Some typical questions you may have when switching mortgage lenders:

Will I pay a penalty if I transfer my mortgage?

There are no fees or payout penalties if you switch at mortgage renewal, otherwise there likely will be a penalty, although often paying the penalty to get a lower rate can save thousands.

Find the Perfect Home with a Mortgage including Home Renovations

Posted by Brad Speniel | May 22, 2015 at 1:22 pm

ESTIMATED READING TIME: 1 minute

Many homebuyers looking at older properties find themselves in a common predicament: they’ve found a property that suits them, but it needs some costly and immediate upgrades.

Many buyers add the costs of those immediate home renovations into their mortgage, instead of racking up credit card bills or selling investments to pay for the upgrades. Known as a “purchase plus improvements” mortgage, this type of mortgage covers the sale price of the home, plus any renovations that would increase the value of the property, with as little as 5 per cent down.

If you’re buying a home but want to add a second story, finish a basement or redo a kitchen, it can make a lot of sense to add those costs to your mortgage. That way you can spread your payments over the life of the mortgage and have a cost-effective way to get your dream home. You can also use your pre-payment privileges to pay the renovation off faster. The process is actually quite simple:

more Find the Perfect Home with a Mortgage including Home Renovations

The Mortgage Glossary: What is the Qualifying Rate?

Posted by Brad Speniel | May 22, 2015 at 1:11 pm

ESTIMATED READING TIME: 1 minute

In 2010, the Department of Finance introduced the Qualifying Rate as a new way to assess borrower eligibility and ensure borrowers can handle their payments should rates begin to rise. Your lender will use the qualifying rate to calculate your debt service ratios, which must be at or below their guidelines. The qualifying rate is a 5-year rate published every week by the Bank of Canada. For terms less than 5 years and for all variable rate mortgages, the qualifying interest rate is used if it is higher than the contract rate. For 5-year terms and longer, the qualifying rate is the contract rate i.e the rate your lender is offering you.

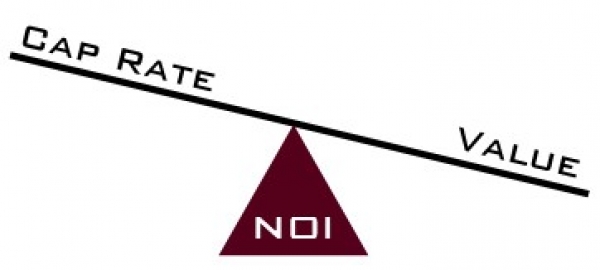

Understanding the Real Value of Properties

Posted by Brad Speniel | May 22, 2015 at 12:46 pm

ESTIMATED READING TIME: 1 minute

At Canada’s Best Mortgage, we strongly believe in keeping you well informed. With that in mind, we are constantly reading and researching to find the best articles and information available to provide to you. We recently read Canadian Real Estate Wealth’s “Understanding the Real Value of Properties” and are excited to share this valuable resource.